Financial Wellness Matters

Support Your Workforce's Financial Stability

Express Wages is the only EWA platform that automatically builds the savings cushion that prevents turnover-triggering financial crises.

Express Wages is the only EWA platform that automatically builds the savings cushion that prevents turnover-triggering financial crises.

Express Wages is the only EWA platform that automatically builds the savings cushion that prevents turnover-triggering financial crises.

Why it matters

The Real Problem Behind Turnover

Financial stress doesn't just hurt employees—it directly impacts your workforce stability and operational performance. When workers are financially unstable, it shows up in attendance, engagement, and retention.

There's no room for the unexpected

There's no room for the unexpected

There's no room for the unexpected

Financial stress doesn't just hurt employees—it directly impacts your workforce stability and operational performance. When workers are financially unstable, it shows up in attendance, engagement, and retention.

Without a buffer, one car repair or medical bill triggers the financial crisis that leads to turnover.

Financial stress doesn't just hurt employees—it directly impacts your workforce stability and operational performance. When workers are financially unstable, it shows up in attendance, engagement, and retention.

Without a buffer, one car repair or medical bill triggers the financial crisis that leads to turnover.

Financial stress doesn't just hurt employees—it directly impacts your workforce stability and operational performance. When workers are financially unstable, it shows up in attendance, engagement, and retention.

Without a buffer, one car repair or medical bill triggers the financial crisis that leads to turnover.

Pay timing doesn't match real-life bills

Pay timing doesn't match real-life bills

Pay timing doesn't match real-life bills

Rent, utilities, and essentials regularly hit before payday, creating ongoing cash-flow pressure even for fully employed workers.

Rent, utilities, and essentials regularly hit before payday, creating ongoing cash-flow pressure even for fully employed workers.

Rent, utilities, and essentials regularly hit before payday, creating ongoing cash-flow pressure even for fully employed workers.

Traditional wellness programs don't work

Traditional wellness programs don't work

Traditional wellness programs don't work

Time-constrained employees won't complete financial literacy modules or attend webinars. Education doesn't build buffers or improve cash flow management - automation does. Express Wages' wellness program takes a behavioral science approach that leads to actual financial action.

Time-constrained employees won't complete financial literacy modules or attend webinars. Education doesn't build buffers or improve cash flow management - automation does. Express Wages' wellness program takes a behavioral science approach that leads to actual financial action.

Time-constrained employees won't complete financial literacy modules or attend webinars. Education doesn't build buffers or improve cash flow management - automation does. Express Wages' wellness program takes a behavioral science approach that leads to actual financial action.

The Reality

Why Earned Wage Access Alone Isn't Enough

Timing helps — stability requires more.

EWA Helps With Timing But Doesn't Address Stability

EWA Helps With Timing But Doesn't Address Stability

EWA Helps With Timing But Doesn't Address Stability

Earned wage access solves the pay-timing gap, helping employees avoid overdraft fees and high-cost payday loans. But without an emergency savings buffer and cash flow management, the same financial shocks keep happening— and the same patterns of stress, disengagement, and turnover persist.

That's the gap most EWA providers ignore. Access to earned wages stabilizes today. Building a buffer prevents tomorrow's crisis. Express Wages is the only platform that does both.

Earned wage access solves the pay-timing gap, helping employees avoid overdraft fees and high-cost payday loans. But without an emergency savings buffer and cash flow management, the same financial shocks keep happening— and the same patterns of stress, disengagement, and turnover persist.

That's the gap most EWA providers ignore. Access to earned wages stabilizes today. Building a buffer prevents tomorrow's crisis. Express Wages is the only platform that does both.

Earned wage access solves the pay-timing gap, helping employees avoid overdraft fees and high-cost payday loans. But without an emergency savings buffer and cash flow management, the same financial shocks keep happening— and the same patterns of stress, disengagement, and turnover persist.

That's the gap most EWA providers ignore. Access to earned wages stabilizes today. Building a buffer prevents tomorrow's crisis. Express Wages is the only platform that does both.

Our Approach to Financial Wellness

A trust-first model built around how employees actually live and work—not how we wish they would.

Starts With Stability, Not Education

We begin with reliable earned wage access - because you can't build savings when you're in crisis mode. EWA eliminates the immediate cash flow stress that prevents workers from thinking about tomorrow.

Starts With Stability, Not Education

We begin with reliable earned wage access - because you can't build savings when you're in crisis mode. EWA eliminates the immediate cash flow stress that prevents workers from thinking about tomorrow.

Starts With Stability, Not Education

We begin with reliable earned wage access - because you can't build savings when you're in crisis mode. EWA eliminates the immediate cash flow stress that prevents workers from thinking about tomorrow.

Starts With Stability, Not Education

We begin with reliable earned wage access - because you can't build savings when you're in crisis mode. EWA eliminates the immediate cash flow stress that prevents workers from thinking about tomorrow.

Earn Trust Before Expanding Features

Unlike platforms that overwhelm users with features, we unlock tools sequentially. Users experience stability through EWA, then we offer bite-sized prompts, insights, and saving and planning tools - but only after proving value first.

Earn Trust Before Expanding Features

Unlike platforms that overwhelm users with features, we unlock tools sequentially. Users experience stability through EWA, then we offer bite-sized prompts, insights, and saving and planning tools - but only after proving value first.

Earn Trust Before Expanding Features

Unlike platforms that overwhelm users with features, we unlock tools sequentially. Users experience stability through EWA, then we offer bite-sized prompts, insights, and saving and planning tools - but only after proving value first.

Earn Trust Before Expanding Features

Unlike platforms that overwhelm users with features, we unlock tools sequentially. Users experience stability through EWA, then we offer bite-sized prompts, insights, and saving and planning tools - but only after proving value first.

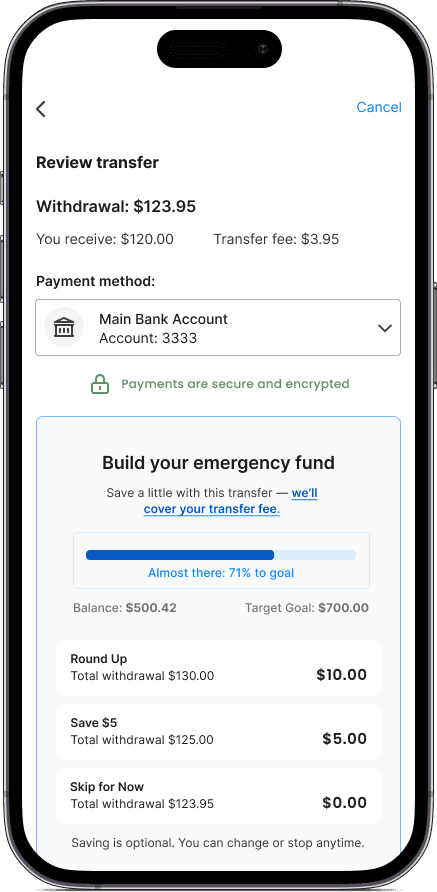

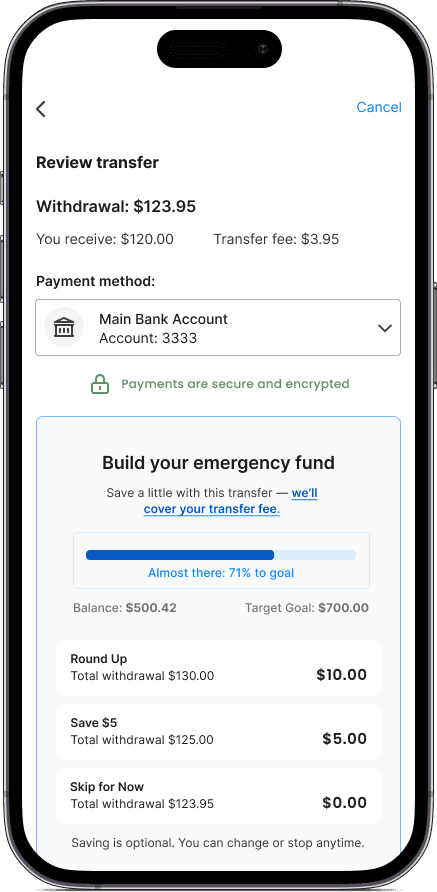

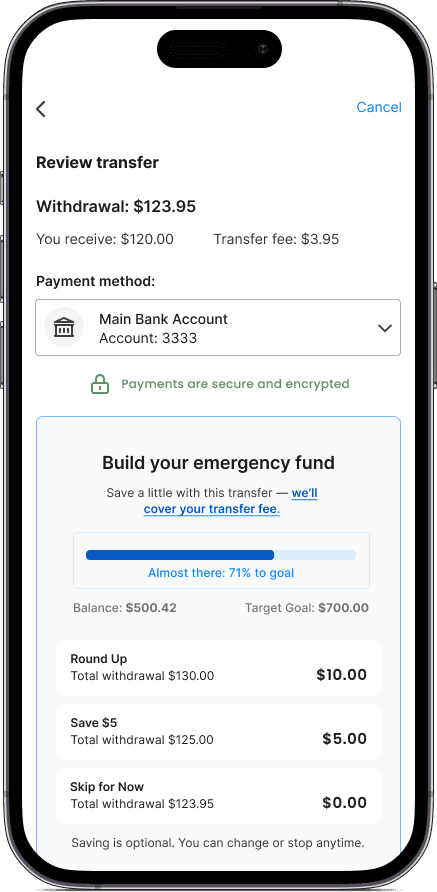

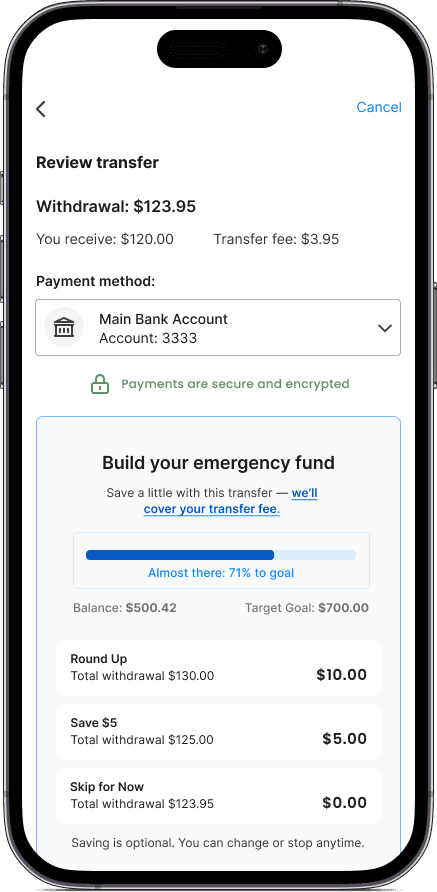

Automate, Don't Rely on Willpower Solely

Our behavioral finance research shows defaults and prompts outperform education for time-constrained workers. We use the moment of need (EWA transaction) to help users build savings automatically, rather than relying on them to initiate savings.

Automate, Don't Rely on Willpower Solely

Our behavioral finance research shows defaults and prompts outperform education for time-constrained workers. We use the moment of need (EWA transaction) to help users build savings automatically, rather than relying on them to initiate savings.

Automate, Don't Rely on Willpower Solely

Our behavioral finance research shows defaults and prompts outperform education for time-constrained workers. We use the moment of need (EWA transaction) to help users build savings automatically, rather than relying on them to initiate savings.

Automate, Don't Rely on Willpower Solely

Our behavioral finance research shows defaults and prompts outperform education for time-constrained workers. We use the moment of need (EWA transaction) to help users build savings automatically, rather than relying on them to initiate savings.

Provide Weekly Cash Flow Support, Not Monthly Budgets

We provide weekly cash flow visibility and planning tools designed for paycheck-to-paycheck reality - not idealized monthly budgets that don't match how your workers actually live.

Provide Weekly Cash Flow Support, Not Monthly Budgets

We provide weekly cash flow visibility and planning tools designed for paycheck-to-paycheck reality - not idealized monthly budgets that don't match how your workers actually live.

Provide Weekly Cash Flow Support, Not Monthly Budgets

We provide weekly cash flow visibility and planning tools designed for paycheck-to-paycheck reality - not idealized monthly budgets that don't match how your workers actually live.

Provide Weekly Cash Flow Support, Not Monthly Budgets

We provide weekly cash flow visibility and planning tools designed for paycheck-to-paycheck reality - not idealized monthly budgets that don't match how your workers actually live.

Build Financial Resilience, Not Just Access

Our goal is to help workers break the patterns that keep them reliant on early wage access. We track the metrics that matter: growing savings balances, declining EWA frequency, reduced self-reported stress, improved attendance, and deeper engagement with planning tools. When these indicators move, you'll know your workforce is becoming more financially resilient - not just accessing the same paycheck earlier.

Build Financial Resilience, Not Just Access

Our goal is to help workers break the patterns that keep them reliant on early wage access. We track the metrics that matter: growing savings balances, declining EWA frequency, reduced self-reported stress, improved attendance, and deeper engagement with planning tools. When these indicators move, you'll know your workforce is becoming more financially resilient - not just accessing the same paycheck earlier.

Build Financial Resilience, Not Just Access

Our goal is to help workers break the patterns that keep them reliant on early wage access. We track the metrics that matter: growing savings balances, declining EWA frequency, reduced self-reported stress, improved attendance, and deeper engagement with planning tools. When these indicators move, you'll know your workforce is becoming more financially resilient - not just accessing the same paycheck earlier.

Build Financial Resilience, Not Just Access

Our goal is to help workers break the patterns that keep them reliant on early wage access. We track the metrics that matter: growing savings balances, declining EWA frequency, reduced self-reported stress, improved attendance, and deeper engagement with planning tools. When these indicators move, you'll know your workforce is becoming more financially resilient - not just accessing the same paycheck earlier.

"Having access to my earned wages really created longevity for me at the company"

Donyell

"Having access to my earned wages really created longevity for me at the company"

Donyell

"Having access to my earned wages really created longevity for me at the company"

Donyell

OUr differientated approach

Why Express Wages is Different

Research-backed, not buzzwords

Built on behavioral economics and workforce research, not marketing trends

Research-backed, not buzzwords

Built on behavioral economics and workforce research, not marketing trends

Research-backed, not buzzwords

Built on behavioral economics and workforce research, not marketing trends

Research-backed, not buzzwords

Built on behavioral economics and workforce research, not marketing trends

Built around real employee behavior

Designed for how people actually manage money, not idealized financial literacy

Built around real employee behavior

We integrate with 200+ HRIS systems to sync employee data and automate repayments—no manual uploads needed. Takes less than 10 minutes.

Built around real employee behavior

We integrate with 200+ HRIS systems to sync employee data and automate repayments—no manual uploads needed. Takes less than 10 minutes.

Built around real employee behavior

We integrate with 200+ HRIS systems to sync employee data and automate repayments—no manual uploads needed. Takes less than 10 minutes.

Outcome-focused, not feature-driven

Measured by retention and stability, not app downloads or engagement metrics

Outcome-focused, not feature-driven

Measured by retention and stability, not app downloads or engagement metrics

Outcome-focused, not feature-driven

Measured by retention and stability, not app downloads or engagement metrics

Outcome-focused, not feature-driven

Measured by retention and stability, not app downloads or engagement metrics

MEET OUR FINANCIAL TEAM

Deep Experience, Practical Perspective

Bring Flexibility to Payday

Join companies that are improving retention, reducing stress, and supporting their teams—without changing a thing about how they run payroll.

Bring Flexibility to Payday

Join companies that are improving retention, reducing stress, and supporting their teams—without changing a thing about how they run payroll.

Bring Flexibility to Payday

Join companies that are improving retention, reducing stress, and supporting their teams—without changing a thing about how they run payroll.

Bring Flexibility to Payday

Join companies that are improving retention, reducing stress, and supporting their teams—without changing a thing about how they run payroll.